[From John Griffin - Edited narrative from a PowerPoint presentation given to various discussion clubs in The Villages, Florida]

Welcome to “The Case for a Universal

Basic Income”. I have prepared a handout

that is appended to the end of this post, and I will reference it at various

points during this presentation. And

since most of you do not know me, I will give some of my background

information. Before I get to that,

however, I would like to start in a fairly unconventional manner by going

straight to the conclusion of this presentation. The evidence to support that conclusion will

come later. The conclusion has two

parts.

Part 1: A

statement of “The Problem”

•

Automation,

computerization, corporate mergers, and globalization have eliminated so many

jobs that we no longer have enough worthwhile jobs for all who need and want

them.

•

Those

same processes will continue (and probably accelerate), and the job shortage

will only get worse.

Part 2: The Proposed Solution

• Provide a Universal Basic Income

(UBI) to all citizens over the age of 18 regardless of their income or

employment status.

•

The

UBI will be enough to cover basic necessities – food, shelter and clothing.

• The UBI will not be taxable unless

total income is well in excess of the UBI.

This is necessary so as not to create a disincentive to finding or

creating a job whenever that is possible.

•

Medical

care is a separate issue and will not be covered by the UBI.

In earlier versions of

this presentation I waited until I was about ¾ finished before I even mentioned

the Universal Basic Income (UBI) as a possible solution to “The Problem”. And the phrase “Universal Basic Income” was

certainly not in the title. I think I

was afraid of being immediately labeled as just another bleeding heart Socialist

intent on taking money from hard working people and giving it to

freeloaders. I was afraid that once the

Socialist labeled was applied, many people would feel justified in just rolling

their eyes and tuning me out. Two things

have happened to make me more bold: 1. I

have become even more convinced that a UBI is not only a viable solution, but

may well be the best solution, to “The Problem”; 2. Discussion of the UBI is increasing

in the news media – giving me a feeling of safety in numbers.

• Rise of the Robots: Technology and

the threat of a jobless future (Martin

Ford - 2015)

• Raising the Floor: How a universal

basic income can renew our economy and rebuild the American Dream (Andy Stern –

2016)

Martin Ford has over

25 years experience as a software developer and computer designer in that area

of Northern California that has come to be known as Silicon Valley. He also wrote an earlier book titled “The

Lights in the Tunnel” (2009) discussing the issue of technological

unemployment.

From 1996 to 2010 Andy

Stern was president of the Service Employees International Union, the largest private

union in the country. He left that

position because he felt he needed to find a better way to advance the

interests of his constituents.

Subsequently, he has been speaking and writing on the subject of the

Universal Basic Income.

Some quotes used in

this presentation and attributed to notable individuals are found in the above

books.

My

Background

First a confession – I have no formal

training in economics. I have, however,

had a long-time interest in reading about economies and how they work and often

do not work.

I do have a BS in Computer Science

and Mathematics from Michigan State University.

I spent my career writing software

and designing computer hardware in Silicon Valley – an interesting parallel to

Martin Ford’s career. As far as I know

we never met.

I have had a lifelong

interest in Machine Intelligence (aka: AI or Artificial Intelligence), and I

believe I have a good feel for what is required in automating various jobs in

our economy.

My personal

beliefs

Why do I mention my personal beliefs? I do that so you will better understand my

motives during the remainder of this presentation.

1. I am a big fan of our capitalist

economic system and believe that such a system is the most efficient way to

bring products and services to the people.

I am not a fan of Socialist economies.

I feel that we only need to look at examples such as the former Soviet

Union, Cuba, and the basket case that Venezuela is today to see the many ways

that Socialism can fail.

2. I believe that entrepreneurs and

capitalists should be celebrated and encouraged. They should own and administer the means of

production, and produce and distribute their goods in whatever way maximizes

their profits. I do not believe that the

word “profit” should be a swear word.

3. I believe that the best way to

encourage capitalism is to allow risk takers to keep the lion’s share of what

they create.

However, I also believe that our

economy has evolved (and continues to evolve) toward a winner-take-all system

that fails to meet the needs of an ever-increasing percentage of our population. The people, as voters, will not allow such a

system to persist.

That is why I have chosen to subtitle

this presentation as: “Saving Capitalism

in the Age of Automation“.

At this point I will make one

additional attempt to convince any remaining doubters that a Universal Basic

Income is not a Socialist program. The Merriam-Webster

dictionary defines Socialism as:

1. any of various economic and

political theories advocating collective or governmental ownership and

administration of the means of production and distribution of goods

2. a system of society or group

living in which there is no private property

3. a system or condition of society in

which the means of production are owned and controlled by the state

A UBI leads to none of the

above. When a government nationalizes

your company, that is Socialism. When a

government levies reasonable taxes and fees for a legitimate purpose, that is

just a cost of doing business.

This presentation will explore two

questions:

1. What is the evidence that “The

Problem” actually exists?

2. What are the reasons for believing

that a Universal Basic Income is a good solution to The Problem, and what might

result if we do provide it?

Question 1:

Does “The Problem” really exist?

In other words: Is it true that

automation, computerization, consolidation and globalization have caused an

employment crisis?

This same question can also be asked

in a form that has come to be known as “The Machinery Question.” It is typically expressed as follows: “Hasn’t

technological advancement always resulted, eventually, in the creation of more

and higher paying jobs than are destroyed?”

We will start examining the evidence

for this question with the following diagram which shows the distribution of

our labor force by economic sector from 1840 to 2010.

Economists often divide our economy

into three sectors: Agriculture (which includes hunting, fishing, forestry and

farming), Industry (which includes construction, mining and manufacturing) and

Services which is conveniently defined to include everything else. That is nice since it makes the percentages

on this chart add to 100 percent.

We see that in 1840 nearly 70% of our

labor force was involved in Agriculture.

Since that time, due to automation and the consolidation of small farms

into larger ones, the Agriculture labor force has declined to where it is less

than 2% of our overall labor force today.

And yet we have all of the food we need and a nice surplus for export. Clearly, automation has not created more and

better paying jobs in the Agriculture sector than it destroyed. But, no one claimed that automation would

create new jobs in the same sector in which they were destroyed. And, in fact, we see that the percentage of

our labor force in the Industrial sector increased steadily from 1840 to 1950

with a short timeout for the Great Depression.

But then in 1950 the percentage in the Industrial sector also began to

decline – largely due to automation. All

the while, the percentage in the Services sector continued to rise.

So – some sectors lose employment,

and some sectors (namely the Services sector) gain employment. And since the unemployment rate is currently

under five percent, everything is fine – right?

Well, no. Our most

recent recession (the so-called Great Recession) officially began in December, 2007 and ended in June, 2009. So after just 18 months the economy was

growing again and would soon be back to record levels of output. However, the unemployment rate remained

stubbornly high. In a very real sense this was a jobless

recovery. Output was rising, but

employment was lagging. The Federal

Reserve responded to this unprecedented situation with the unprecedented

measure of lowering interest rates to nearly zero and holding them there to

this day. And when zero interest rates

weren’t enough, the Federal Reserve invented a new strategy called quantitative

easing, and flooded the economy with cash to stimulate demand and production. After nearly eight years of this extreme

strategy, the economy finally recovered the jobs that were lost in that

18-month recession.

But even then, the

unemployment rate is only part of the picture.

The unemployment rate is that percentage of workers who are actively

looking for work but are still unemployed.

It does not count those who have become discouraged and have dropped out

of the labor force altogether. Those

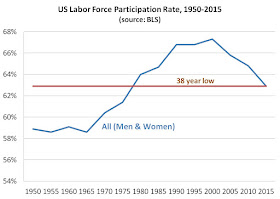

dropouts are accounted for in the following diagram which shows the “labor

force participation rate”.

This diagram shows the percentage of

the working age population currently working or actively looking for work. That percentage increased from 1965 to the

year 2000, but then it declined sharply and today is at a 38-year low. But you may think that since it increased in

the past, maybe it will go up again. This

next diagram shows why that is unlikely to happen.

Here we see that the participation

rate for Men has actually been declining steadily since at least 1950 – from

87% to under 70%. So what happened when

the primary family wage earner was having increasing trouble finding and

holding a worthwhile job? The women

stepped in to help support the family.

Their labor participation rate rose from 33% in 1950 to 60% in 2000. But now we see that the participation rate

for women has been declining since then, and the result is the 38-year low.

So - The unemployment rate is

relatively low, but only because of unprecedented stimulus, and because it ignores

the decline in the participation rate. But

the situation is seen to be even worse when we consider the underemployment

rate.

The Underemployment rate is equal to

the unemployment rate plus the percentage of workers who have part time work

but would like full time work. In

November of 2015, the U.S. underemployment rate was 14.6 percent, so nearly ten percent of our employed workers wanted

full time work but could not find it.

But wait – it is even worse than

that!

In addition to the underemployed

workers, there are full time workers who are earning less than they did in a previous job. A good example would be laid off factory

workers who used to earn $25 or more per hour but are now earning little more

than minimum wage manning a cash register at Wal-Mart or in some department

store.

And other workers have never found

employment that pays at a level commensurate with their education level, their

experience or their skills. A good

number of recent college graduates are in that category.

We will call them the underpaid

workers.

It is difficult to

find data specifically for underpaid workers because it is difficult to establish

the level at which a given worker is considered to be underpaid, but we can get

a good general idea of what is happening from this next diagram.

This diagram shows two

trend lines. The one labeled “major

sector productivity” rises steadily from the late 1940s to approximately

2010. The second trend line, labeled

“real (i.e. inflation-adjusted) wages of goods-producing workers” tracks the

first trend line from the late 1940s until the early 1970s. During that time increasing productivity and

production resulted in increasing real wages.

Labor shared in the increasing prosperity. Then the wages trend line stopped rising and

remained essentially flat to this day in a phenomenon that some economists

refer to as “The Great Decoupling”.

But why? Why have real hourly wages been stagnant for over

40 years while productivity continues to rise?

There is a simple

answer: supply and demand.

The demand for workers

declines when there are other less expensive ways to produce the output. When

demand goes down, pay goes down - or, in this case, goes flat for 40

years.

But what are these

other less expensive ways to get a job done?

The first way is Automation and the

second is Foreign Labor. We could spend

quite some time debating the relative contributions of these two factors. Instead I will direct your attention to the article

titled “Why robots, not trade, are behind so many factory job losses” at the top of the Appendix. That article claims that the vast majority of

job losses are due to automation rather than foreign labor.

It can also be noted

that the percentage of the labor force in the Industrial sector in China, the

proverbial land of cheap labor, has started to decline. China also recently surpassed the U.S. and

Japan in the number of industrial robots installed. So even the Chinese are looking to replace

workers with automation.

A second look at the

Productivity vs Real Wages diagram (above) can further aid our understanding

when we consider that productivity is defined as that output produced by a

given input of labor and

capital. For “capital” you can

substitute “labor saving machinery”.

When the increased productivity is due to machines, there is little

incentive or reason to pay more to labor.

This brings us to the point where we

can attempt to answer “The Machinery Question”.

Once again, that question is often

asked in the following form:

“Hasn’t automation, in the long run, always created more (and better

paying) jobs than it destroys?”

Since the beginning of the Industrial

Age, the answer to this question has consistently been “Yes”. Machines have taken over much of physical

labor and freed workers to do the better paid “brain work” of design, planning

and supervision.

But then, starting in the 60s and

70s, computers became less expensive and more common and brain work was no

longer limited to humans.

Over time, automation chased us out

of the Agricultural sector, and into the Industrial and Services sectors. Then it chased us out of the Industrial

sector as well. Now it is invading the

Services sector and workers have “nowhere else to hide”.

In summary we can safely say “This

time it really is different”. Automation

is destroying more jobs than it is creating.

But why are employers trying so hard

to replace us with machines?

The only problem we have in answering

this question is where to start.

• Machines can increase productivity –

often substantially.

• Machines can work 24/7.

• Machines don’t make careless

mistakes.

• Machines won’t call in sick.

• Machines won’t form a union and

strike for higher wages.

• Machines won’t leave to take another

job.

• Machines won’t steal from their

employers.

• Machines don’t need pensions and

Social Security.

• Machines do need maintenance, but

that is insignificant compared to human health care costs.

• Machines don’t sue their employers or

get their employers sued because of careless mistakes.

• A working machine design can be

readily copied, but each human worker must be individually trained.

I created this list in about fifteen

minutes. In another fifteen minutes I

could add several more items. However,

the bottom line is obvious. Human

workers are a pain in the neck. Can we

really blame employers for wanting to replace us with machines?

So, wages are stagnant, our employers

would rather do without us, and computers are pushing us out of the job market. What can we do?

Perhaps more education would make us

more valuable and enable us to remain employed.

•

In

1970 8.2% of women and 14.1% of men had four or more years of college.

•

By

2014 those numbers had risen steadily to 32% and 31.9% respectively.

And yet – according to the Bureau of Labor

Statistics, 260,000 Americans with bachelor’s degrees were earning the federal minimum

wage or less in 2013. And that is more

than double the number in the same situation in 2005.

At this point I will direct your

attention to the short article near the end of the Appendix which is titled “Millennials Are Falling Behind Their Boomer

Parents”. This is in spite of the

fact that Millennials are better educated than their Boomer parents.

Why is this happening?

I offer the following quote from page

252 of Martin Ford’s book as a partial answer to this question:

“We are running up against a

fundamental limit both in terms of the capabilities of the people being herded

into colleges and the number of high-skill jobs that will be available for them

if they manage to graduate.”

“The problem is that the skills

ladder is not really a ladder at all: it is a pyramid, and there is only so

much room at the top.”

In other words, what will we do when

we only have jobs for “rocket scientists” and most people simply are not

capable of doing those jobs? And even if

they were capable, we would not have enough such jobs at the top of the pyramid

for all who need them.

At this point I will direct your attention

to near the middle of the Appendix to an excerpt from chapter 4 of Andy Stern’s

book which is titled “The New Landscape

of Work”. It tells of a poignant

encounter with a 28-year-old woman facing the real prospect of having to move

back in with her parents – even after earning a college degree and trying her

best to find worthwhile work.

This brings us to the second question

being examined in this presentation:

Question 2: What are the reasons for

believing that a Universal Basic Income is a good solution to “The Problem”?

Reason #1

for providing a Universal Basic Income:

Because it simply may be the only

effective solution to “The Problem”.

All conventional remedies are falling

short. These include:

•

Extended

economic stimulus (near-zero interest rates, business tax cuts, etc.)

•

Increased

levels of education

•

Extended

unemployment payments

•

Job

retraining assistance

Reason #2

for providing a Universal Basic Income:

Because it gives each citizen the

ability to purchase the goods and services created by the economy. Without that demand the economy will not

create the supply. Our economic policy

has long emphasized supply-side stimulus.

It may well be time to emphasize demand-side stimulus.

But isn’t there something fundamentally

wrong with taking money from people who have earned it and giving it to people

who haven’t earned it?

Let’s take an example:

Mark Zuckerberg – founder of Facebook

– age: 32 – net worth: $50+ billion

By all accounts, young Mr. Zuckerberg

is a genius, and a hard working prodigy of business strategy and business management. If anyone deserves to be a billionaire, one

can easily make the case that he does.

At the same time, however, we should

not forget that his company could not exist without:

•

the

Internet

•

modern

computer technology

•

a

population educated well enough to work for him or to use his product

•

a

legal system that keeps others from stealing his work

•

a

military strong enough to keep the peace (After all, it is difficult to run a

company if foreign soldiers are marching up and down Main Street.)

All of these things are part of the

societal infrastructure without which Facebook and all other companies would be

much less prosperous or even non-existent.

Neither Mr. Zuckerberg nor his company created that infrastructure. We did!

We and our predecessors over the previous decades and centuries created

the society that enables the prosperity of today’s enterprises.

Reason #3

for providing a Universal Basic Income:

This brings us to reason #3 for

providing a UBI for people who haven’t “earned it”. And that reason is: “Because all citizens,

past and present, have earned the UBI by contributing to the creation of

our current society”.

If you are bothered by the idea of

raising taxes on the wealthy and their companies to pay for the UBI, then let

me offer an alternative. Don’t think of

these levies as taxes.

Instead,

•

think

of the UBI as a dividend payable for those prior contributions,

•

or,

think of it as an inheritance received by current citizens from our

predecessors (After all, most people have no problem leaving an inheritance to

their heirs even though their heirs did not “earn it”.),

•

or,

think of it as a license fee payable by businesses for the use of our societal

infrastructure.

Reason #4

for providing a Universal Basic Income:

Because we can afford it. A UBI simply would not be possible in a poor

country, and our country is not poor. Our

GDP for 2015 was 17.947 trillion dollars.

Our population at the end of 2015 was 321.57 million. If we do the math, we see that our per capita

GDP at the end of 2015 was $55,810. That

is nearly $56,000 per year for every man, woman and child in the United States. If our per capita GDP is that high, you might

ask, why do we need a UBI? The answer,

as we are all well aware, is that the GDP is not at all evenly distributed.

How much should the UBI provide? Andy Stern says approximately $1,000 per month

for each citizen over the age of 18. This

will cost between 2 and 3 trillion dollars per year (between 11% and 17% of our

GDP). This level of expenditure will

still leave over 80% of our GDP for other purposes, including providing the

incentive for capitalists to do what they do so well. After all, we don’t want to kill the goose

that lays the golden egg.

Where will we get the money to pay

the UBI? The money already exists.

Approximately $1 trillion can be had by

replacing all or some of the 126 current welfare programs (e.g. food stamps,

housing assistance, EITC) and the expensive bureaucracies that manage them. This should warm the hearts of conservatives who

believe that smaller government is better government.

Another $1+ trillion can be had by

reducing or eliminating tax deductions that primarily benefit the wealthy. These include:

•

Accelerated

Depreciation

•

Preferential

treatment of capital gains

•

Investment

expenses

Many of these

deductions were created to provide extra money for business owners to invest

and thereby create jobs. In an automated

world, however, business owners may simply use the money to purchase automated

equipment and not create jobs. In that case, it is

legitimate to ask if these deductions are still valid.

The rest (and more) can be had by implementing

a value added tax (VAT), or a financial transaction tax, or even a wealth tax,

etc. If we fully pay for the UBI with

the aforementioned methods then the UBI will not add anything at all to the

national debt.

Reason #5

for providing a Universal Basic Income:

Because it will eliminate poverty

overnight, and will replace scores of existing programs and eliminate the

bureaucracies behind them.

The poverty threshold in the U.S. is

$12,000 per year for an individual. The

poverty threshold for a couple is $16,000 per year. Therefore, a UBI of $1,000 per month per

person would eliminate poverty immediately – by definition.

I direct your attention to near the

end of the Appendix for two quotes from notable individuals from several years

ago. They both advocated for the

elimination of poverty directly by means of a UBI. This not a new idea.

Reason #6

for providing a Universal Basic Income:

Because it will save capitalism!

If no changes are made, our current

economic system will trend toward ever fewer jobs and ever more income and

wealth inequality. Such a system is

unsustainable. The people, as voters,

will simply take increasingly disruptive measures until their needs are met. In the beginning they may be attracted to the

rhetoric of populist demagogues. They

may even vote to put one in the White House.

Can it get worse than that? Of

course. Just ask Louis XVI or Marie

Antoinette.

I direct your attention to near the

end of the Appendix for a recent press release from the World Economic Forum

held in January of this year titled “World

Economic Forum Says Capitalism Needs Urgent Change”. This press release calls for changes to our

capitalist system in order to defuse such citizen discontent.

The following is a quote from Andrew

Grove, co-founder of Intel Corporation, and a champion of our capitalist

system:

“Our generation has seen the decisive

victory of free market principles over planned economies. So we stick with this belief largely

oblivious to emerging evidence that while free markets beat planned economies,

there may be room for a modification that is even better.”

I would add that there is not only

room for such a modification, but also a need.

Are we going to vote for a UBI

tomorrow? No! – Not that soon.

• It will take more time for this idea to gain

exposure and political momentum.

• It will take time for more people to realize

that the promises of politicians to “bring back our jobs” are

just hollow political rhetoric.

• It will take time for more people to realize

that the fast food job they took to tide them over during their search for a

real job, has become their new career.

In conclusion: I believe that a

Universal Basic Income should receive serious consideration as a solution to

the growing problems of unemployment and income and wealth inequality. I invite all interested parties to engage in

a discussion of its merits and shortcomings.

I will start that process by offering

short answers to some commonly asked questions.

1. How can we be sure that

politicians won’t be tempted to buy votes by raising the UBI to an

unsustainable percentage of GDP?

Answer: This is a legitimate

concern. If the UBI takes too much of

GDP then incentives for producers will be insufficient to maintain

production. It may well be necessary to

limit the UBI to a certain percentage of GDP by constitutional amendment.

2. Should we provide some form of UBI

for children under the age of 18?

Answer: While we don’t want children

living in poverty, neither do we want people to have children simply because

they will get more money. Perhaps 0.8 of

a UBI for the first child, 0.6 for the second, 0.4 for the third and nothing

for subsequent children.

3. Would the UBI be paid to foreign

workers and students while they are in the US?

Answer: No. Our UBI would be for US citizens only. Other countries would need to provide for

their citizens.

END OF NARRATIVE

APPENDIX: HANDOUT TO

ACCOMPANY THE NARRATIVE

Despite the Republican

presidential nominee's charge that "we don't make anything anymore,"

manufacturing is still flourishing in America. Problem is, factories don't need

as many people as they used to because machines now do so much of the work.

America has lost more than 7

million factory jobs since manufacturing employment peaked in 1979. Yet

American factory production, minus raw materials and some other costs, more

than doubled over the same span to $1.91 trillion last year, according to the

Commerce Department, which uses 2009 dollars to adjust for inflation. That's a

notch below the record set on the eve of the Great Recession in 2007. And it

makes U.S. manufacturers No. 2 in the world behind China.

Trump and other critics are right

that trade has claimed some American factory jobs, especially after China

joined the World Trade Organization in 2001 and gained easier access to the

U.S. market. And industries that have relied heavily on labor -- like textile

and furniture manufacturing -- have lost jobs and production to low-wage

foreign competition. U.S. textile production, for instance, is down 46 percent

since 2000. And over that time, the textile industry has shed 366,000, or 62

percent, of its jobs in the United States.

But research shows that the

automation of U.S. factories is a much bigger factor than foreign trade in the

loss of factory jobs. A study at Ball State University's Center for Business

and Economic Research last year found that trade accounted for just 13 percent

of America's lost factory jobs. The vast majority of the lost jobs -- 88

percent -- were taken by robots and other homegrown factors that reduce

factories' need for human labor.

"We're making more with

fewer people," says Howard Shatz, a senior economist at the Rand Corp.

think tank.

General Motors, for instance, now

employs barely a third of the 600,000 workers it had in the 1970s. Yet it

churns out more cars and trucks than ever.

Or look at production of steel

and other primary metals. Since 1997, the United States has lost 265,000 jobs

in the production of primary metals -- a 42 percent plunge -- at a time when

such production in the U.S. has surged 38 percent. Allan Collard-Wexler of Duke University and

Jan De Loecker of Princeton University found last year that America didn't lose

most steel jobs to foreign competition or faltering sales. Steel jobs vanished

because of the rise of a new technology: Super-efficient mini-mills that make

steel largely from scrap metal.

The robot revolution is just

beginning. The Boston Consulting Group

predicts that investment in industrial robots will grow 10 percent a year in

the 25-biggest export nations through 2025, up from 2 or 3 percent growth in

recent years.

The economics of robotics are

hard to argue with. When products are replaced or updated, robots can be

reprogrammed far faster and more easily than people can be retrained. And the costs are dropping: Owning and

operating a robotic spot welder cost an average $182,000 in 2005 and $133,000

in 2014 and will likely run $103,000 by 2025, Boston Consulting says. Robots

will shrink labor costs 22 percent in the United States, 25 percent in Japan

and 33 percent in South Korea, the firm estimates.

CEO Ronald De Feo is overseeing a

turnaround at Kennametal, a Pittsburgh-based industrial materials company. The

effort includes investing $200 million to $300 million to modernize

Kennametal's factories while cutting 1,000 of 12,000 jobs. Automation is

claiming some of those jobs and will claim more in the future, De Feo says.

"What we want to do is

automate and let attrition" reduce the workforce, he says.

Visiting a Kennametal plant in

Germany, De Feo found workers packing items by hand. He ordered $10 million in

machinery to automate the process in Germany and North America.

That move, he says, will produce

"better quality at lower cost" and "likely result in a

combination of job cuts and reassignments."

But the rise of the machines

offers an upside to some American workers: The increased use of robots —

combined with higher labor costs in China and other developing countries — has

reduced the incentive for companies to chase low-wage labor around the world.

Multinational companies are also

rethinking how they spread production across the globe in the 1990s and 2000s, when

they tended to manufacture components in different countries and then assemble

a product at a plant in China or other low-wage country. The 2011 earthquake

and tsunami in Japan, which disrupted shipments of auto parts, and the

bankruptcy of the South Korean shipping line Hanjin Shipping, which stranded

cargo in ports, exposed the risk of relying on far-flung supply lines.

"If your supply chain gets

interrupted and your raw materials are coming from offshore, all of a sudden

shelves are empty and you can't sell product," says Thomas Caudle,

president of the North Carolina-based textile company Unifi.

So companies have been returning

to the United States, capitalizing on the savings provided by robots, cheap

energy and the chance to be closer to customers.

"They don't have all their

eggs in that Asian basket anymore," Caudle says.

Over the past six years, Unifi

has added about 200 jobs, bringing the total to over 1,100, at its automated

factory in Yadkinville, North Carolina, where recycled plastic bottles are

converted into Repreve yarn. Unmanned carts crisscross the factory floor,

retrieving packages of yarn with mechanical arms — work once done by people.

In a survey by the consulting

firm Deloitte, global manufacturing executives predicted that that the United

States — now No. 2 — will overtake China as the most competitive country in

manufacturing by 2020. (Competitiveness is measured by such factors as costs,

productivity and the protection of intellectual property.)

The Reshoring Initiative, a

nonprofit that lobbies manufacturers to return jobs to the United States, says

America was losing an average of 220,000 net jobs a year to other countries a

decade ago. Now, the number being moved abroad is roughly offset by the number

that are coming back or being created by foreign investment.

Harold Sirkin, senior partner at

Boston Consulting, says the global scramble by companies for cheap labor is

ending.

"When I hear that

(foreigners) are taking all our jobs — the answer is, they're not," he

says.

(Excerpt

from chapter 4 of “Raising the Floor” by Andy Stern)

“Ready for the flight from hell?” she said as she squeezed by

me into the last empty seat on the plane.

I knew exactly what she meant. We

would be spending the next two hours traveling from New York to Detroit on

no-frills Spirit Airlines – “Home of the Bare Fare.”

And yet this slightly unnerved, tall, and brunette young

woman – her name was Kristina – turned out to be the perfect traveling

companion for a guy writing a book about the future of work, because all she

could talk about was how she couldn’t find any.

“I’m twenty-eight, with a degree in medical management and

interdisciplinary health systems from Western Michigan,” she said. “I thought I was going to save the world

after I graduated.” But after a

frustrating few months working in data entry for a Medicaid contractor,

Kristina took a ten-dollar-an-hour job “answering phones and fetching coffee”

at an advertising firm in Birmingham, Michigan.

Over the next several months, she worked her way up to become an

assistant producer of how-to videos.

“But”, she told me, “I think I set myself up for failure. Because it was just this awesome work environment

and this amazing office culture, and you don’t find that. And then the firm lost a major client, and I

was kind of downsized.”

And so Kristina moved to New York. I asked her why.

“I needed a fresh start,” she said. “And I heard ‘if you can make it here, you

can make it anywhere’.”

“I’ve heard that same song,” I said.

“Yeah,” she laughed.

“Sinatra, right?”

But the fact was that Kristina hadn’t had a single interview

after four months of looking for a job through LinkedIn, Craigslist, and other

online networking sites. “Producers with

a lot more experience than me are a dime a dozen in New York. And companies in the medical field are hiring

people with PhDs for the type of work I’m qualified to do with my BA.”

Kristina was less than an hour from

seeing her parents for the first time since she’d left Detroit, and she told me

she was feeling like “a huge failure – like I’m just letting them down.” Her father had come to the United States from

Italy when he was her age – twenty-eight.

He only had $50 in his pocket, but he was a really good cabinet

maker. And he worked hard. And he became a big success, with his own

stores – the American Dream.” His only

goal, she said was for his children to go to college. “Which I did.

And see where it’s gotten me!”

On

a no-frills flight back to Detroit to face the very real prospect of moving

back to live in her parent’s home.

Daily Sun –

Associated Press – Jan 15, 2017

Millennials earn 20 percent less than

boomers did at the same stage of life, despite being better educated.

Education does help boost

incomes. But the median college educated

millennial with student debt is only earning slightly more than a baby boomer

without a degree did in 1989.

The

Associated Press – London – Jan 12, 2017

Reforming the very nature of

capitalism will be needed to combat the growing appeal of populist political

movements around the world, the World Economic Forum said Wednesday. Getting higher economic growth, it added, is

necessary but insufficient to heal the fractures in society that were evident

in the election of Donald Trump as U.S. president and Britain’s vote to leave

the European Union.

Notable Quotes

“There

is no reason why in a free society government should not assure to all,

protection against severe deprivation in the form of a minimum income, or floor

below which nobody need descend.”

-- Nobel economist F. A. Hayek (a

Reagan favorite)

“I am now convinced that the simplest

approach will prove to be the most effective – the solution to poverty is to

abolish it directly by a now widely discussed measure: the guaranteed

income.” – Martin Luther King, Jr. -

1967

“For now, it’s just a handful of

chess and Go and Jeopardy! champions who no longer feel needed and

useful. But what happens to society when it’s tens of millions of us?”

--- Ken Jennings - 74-time Jeopardy!

winner – March 15, 2016 – shortly after a world class Go player was defeated by

a computer. Such a defeat was not

expected for at least another ten years.

Mr. Jennings lost a famous Jeopardy! match to the Watson computer system

in 2011.

John Griffin

There was an increase in female workers during WW2. When males returned from war, female partners were able to withdraw from the workforce. As the top 1% took more of the income pool, average male incomes decreased and females had to go back to work. Increased education of women created greater employment competition. With globalization, manufacturing jobs moved out of the US, going to those in developing countries willing to do the same job for less pay. With transition of the U.S. workforce to more specialized higher paying jobs, married women or their partners could withdraw from the workforce and focus on child-rearing. This may explain why many are no longer seeking employment.

ReplyDeleteValues are changing from focus on materialism to quality of life. It is not clear that technology fails to generate new jobs, since we are currently going through a period requiring workforce re-education. Our welfare system already addresses minimal household income. The danger of providing income that requires no effort is demotivation - especially when there is an anti-materialistic shift in societal values. Funding of a UBI would require a significant redistribution of wealth. That is not a prescription that has led to societal success.

John: THANKS for sharing your well-developed thoughts on a Universal Basic Income (UBI). I've had the pleasure of watching your story develop through successive presentations to a number of discussion clubs in The Villages, FL, and the most recent one, to the Bridgeport Men's Club (published here)is your most comprehensive and compelling. Yet, although I fully accept your conclusion that a combination of automation and globalization has and will continue to eliminate many traditional jobs, I remain unconvinced that a UBI is the correct solution.

ReplyDeleteI strongly hope that others, on all sides of the issue, will join you and me in the Comment section of this Blog in a collegial cross-discussion of this idea.

First, where do we agree? [Text in quote marks below are from your posting, The remaining text is my reaction.]

1) THE PROBLEM IS REAL - Good, satisfying, and lifelong jobs are scarce in the US and may become more so due to automation and globalization.

2) THE UBI IS ONE POSSIBLE APPROACH - If adopted, it should be payable to "... all CITIZENS over the age of 18 regardless of their income or employment status." [Your words, my EMPHASIS.] But what do we do with legal immigrants with work visas? What about undocumented persons working in our country? Is it possible to make the citizenship requirement for UBI stick when the media publishes photos of their innocent children?

3) TRADITIONAL "SOCIALISM" IS NOT THE ANSWER - [You write that you are] "... a big fan of our capitalist economic system and believe that such a system is the most efficient way to bring products and services to the people. [You are] not a fan of Socialist economies. ... we only need to look at examples such as the former Soviet Union, Cuba, and the basket case that Venezuela is today to see the many ways that Socialism can fail. ... entrepreneurs and capitalists should be celebrated and encouraged. They should own and administer the means of production, and produce and distribute their goods ...the best way to encourage capitalism is to allow risk takers to keep the lion’s share of what they create." AMEN!

4) EXISTING INFRASTRUCTURE IS WHAT MAKES ENTRENEURSHIP POSSIBLE - "We and our predecessors over the previous decades and centuries created the society that enables the prosperity of today’s enterprises." Yes, we stand on the shoulders of our ancestors. However, I do not see why the productive efforts of your ancestors, or mine, entitle you, or me, to share of the value they created. And, what if we can prove someone's ancestors were horse thieves, or worse? You suggest we "think of it as an inheritance received by current citizens from our predecessors". Well, if I earn money and, after paying taxes, etc., leave it to my children or some charity, that is MY money and I can decide what to do with it, as can my heirs after they pay inheritance taxes. You further suggest "or, think of it as a license fee payable by businesses for the use of our societal infrastructure." Well, isn't that why we pay income and property taxes for current government expenses such as national defense, highways, police and fire, etc.?

[To be continued in the following Comment]

ReplyDelete[Continuation of my Comment]

Here is where we seem to disagree most significantly:

a) FIXED PERCENT OF GDP TO PAY FOR UBI - In this posting you suggest 11 to 17% of GDP could fund the UBI. Previously you have suggested a limit of 20% of GDP earmarked for UBI. That would provide about $1,000 per month per person. How would we prevent a populist government from increasing that to 30% or 50% or more. You and I have discussed putting the 20% limit into the Constitution. Of course that would be subject to change by Constitutional amendment, so I worry that we'd inevitably slide along to higher and higher percentages. As you say in your posting, Socialism is "a system or condition of society in which the means of production are owned and controlled by the state." By that definition, your UBI would amount to a 20% dose of Socialism, with (IMHO) inevitably increasing doses up to 30% or 50% or more.

b) REPLACING CURRENT WELFARE PROGRAMS WITH UBI - You suggest the UBI would allow us to save a trillion by terminating "all or some of the 126 current welfare programs (e.g. food stamps, housing assistance, etc.) and the expensive bureaucracies that manage them. This should warm the hearts of conservatives who believe that smaller government is better government." Wow! My heart got warm! However, I do not think politicians would be likely to give up the special interest government programs (and associated votes).

c. REDUCING OR ELIMINATING TAX DEDUCTIONS THAT PRIMARILY BENEFIT THE WEALTHY - You suggest another $1+ trillion could be saved. However, I do not think politicians would be likely to give up the special interest government programs (and associated contributions).

My Comment is already in two parts and way too long, so I'll end it here, hoping to see Comments by others and replies by John.

Ira Glickstein

Ira,

ReplyDeleteI did not see all of your comments before I posted my first response. Therefore, I would like to add the following:

In part 2 of your first comments you asked: “Is it possible to make the citizenship requirement for UBI stick when the media publishes photos of their innocent children?”

I believe it will be possible and should be done. Our UBI should not be allowed to serve as an invitation to foreign workers. Their home countries should provide their UBI.

In part 4 you said: “Yes, we stand on the shoulders of our ancestors. However, I do not see why the productive efforts of your ancestors, or mine, entitle you, or me, to share of the value they created.”

I would ask, “Who is more entitled than the general population to the fruits of our ancestor’s labors?”

You also said, “Well, if I earn money and, after paying taxes, etc., leave it to my children or some charity, that is MY money and I can decide what to do with it, as can my heirs after they pay inheritance taxes.”

I disagree that the money you earn is all yours. Let me give another example.

There are Hall of Fame professional athletes from the 1950s and 1960s who made less money in their entire careers than some modern day athletes make in their signing bonus before they play their first game. How is that possible? Are they so much better athletes than their predecessors? Of course they are not. There is much more money in professional sports today because of television revenues and other sources that did not exist in the 50s and 60s. Today’s athletes make much more money because they can command a share of these new revenues. But today’s athletes did not invent television or the infrastructure that enables it. Our predecessors did that, and that should give all citizens a claim to the earnings of modern athletes and of all workers who benefit from our modern infrastructure.

And yes we do pay taxes for all of the items you mention, and we should also pay for the UBI.

John Griffin

OK, I guess my first response actually did not post so here it is again(?)

ReplyDeleteIra,

You raise legitimate and thoughtful questions. I would respond as follows:

a) Even today, without Constitutional Amendments to limit spending, the prevailing mood in Congress is to lower taxes and cut spending. I believe most people and their representatives realize that if we raise taxes too high there will be insufficient incentive for companies to produce what we need. The Amendment will just add more weight in that direction.

I do maintain that “the people” already have a legitimate claim to a “dividend” (or “inheritance” or “license fee”) by virtue of the “investment” they and their predecessors have made to create the societal infrastructure that enables today’s companies to be as prosperous as they are. That claim does not give the people ownership, but it does give them the right to expect that dividend. Such an arrangement does not fit the conventional definition of Socialism.

b&c) I agree there will be significant resistance from special interests. That is one of the main reasons why I don’t expect the UBI to become law for several more years. We must wait until it becomes more obvious that current programs fail to meet the needs of a continually increasing portion of the population.

John Griffin

PMI,

ReplyDeleteThank you for taking the time to comment. You bring up a number of significant issues.

You say, "It is not clear that technology fails to generate new jobs, since we are currently going through a period requiring workforce re-education." I believe that technology does continue to generate new jobs. The issue is whether that is happening fast enough and whether the work force is capable of absorbing the type of education and skills needed for these new jobs. Not many people are capable of being "rocket scientists".

You also say, "The danger of providing income that requires no effort is demotivation - especially when there is an anti-materialistic shift in societal values." Under my proposal, the UBI would barely provide for necessities, so there should still be plenty of motivation to work. The UBI might also give people the freedom to pursue personal interests and low paying work that would not otherwise be feasible without the support provided by the UBI.

And you say, "Funding of a UBI would require a significant redistribution of wealth. That is not a prescription that has led to societal success." It is debatable whether using 11 to 17 percent of the GDP amounts to "a significant redistribution of wealth". You do mention how the 1% are taking more of the income pool. The UBI is one mechanism to address that problem.

Again, thanks for participating.

John Griffin

A report in today's WSJ suggests that some firms are finding it difficult to find workers. Given unemployment now at 4.3%, this does not support the contention that an alleged employment problem currently exists in the US.

ReplyDeleteAn alternative approach to adjusting for the continuing skew in wealth distribution would be to set a standard income multiple for the range of employee remuneration, not necessarily in law but encouraged by national leadership as good practice. Companies abiding by the practice could get favorable tax treatment to encourage adoption of the practice.

A significant proportion of unemployed would find a UBI sufficient to their needs. People who are not driven by need do not compete in performance. The experiment has already been tried and failed in the USSR and remains a principle criticism of our welfare system.

PMI THANKS for your Comments, with which I generally agree. Would you mind letting us know more about you? Are you in The Villages, do I know you? Love, Ira

ReplyDeleteJohn: Your posting has attracted over 100 page views and several excellent comments. Thanks, and I look forward to more new topics by you.

ReplyDeleteThinking about your claim that we each deserve a "dividend, inheritance or license fee" based on the contributions of our ancestors, I wonder if a FAIR distribution of all we owe to those who have come before us would include actually tracing the sources to the recipients, when possible?

Stockholders are entitled to dividends proportional to their investment of capital, or, in the case of the founders, their inspiration and invention and hard work in establishing, promoting, and guiding the enterprise.

Thus, people of Greek heritage living in the US would be ENTITLED to a larger share of the "dividend" due to the undoubtedly great contributions of Hellenistic philosophy and rationality to Western Civilization. Ditto for Italians due to the debt we owe to Roman Civilization. Similarly, since the undoubtedly superior success of Western Civilization is based on "Judeo-Christian" moral principles, Jews and committed Christians are ENTITLED to a larger share.

By that line of reasoning, people now living in Greece, who mostly have a greater biological share of Greek genes than the average American, are ENTITLED to a larger share of the dividend. Why do you restrict the UBI to current US citizens rather than distribute the lion's share to people now living in Greece (or Italy or Israel, etc.:^)?

Love, Ira

PMI,

ReplyDeleteAn unemployment rate of 4.3 percent is good news. However, as I mentioned in my post, we have achieved that goal by holding interest rates near zero for over eight years and by ignoring the fact that the labor force participation rate remains stuck near a 40-year low.

When companies claim that they are having trouble finding workers, the first question I ask is how much pay are they offering. When I worked in the computer industry, I saw many examples of companies claiming that they could not find workers. In many cases those companies were simply building the case for requesting more H-1B visa workers - always at the low end of the pay scale.

Our current welfare programs (unlike the proposed UBI) penalize workers for finding work that pays little more than their welfare check. And if a former welfare recipient loses his job, it may take significant time to re-establish welfare eligibility. These things discourage workers from accepting low wage alternatives to welfare.

You say, "An alternative approach to adjusting for the continuing skew in wealth distribution would be to set a standard income multiple for the range of employee remuneration..."

I agree. This idea has merit - and certainly from a fairness standpoint. However, it only helps those who are employed. I am concerned that we have a job shortage due to technological factors and that that shortage exists (and will get worse) in spite of everyone's best efforts.

You also say, "A significant proportion of unemployed would find a UBI sufficient to their needs. People who are not driven by need do not compete in performance."

You raise a significant question that could occupy an entire blog. "What kind of society would result if the UBI existed?" Would the resulting freedom spark a societal renaissance or cause a slide into sloth and decay? I tend to come down on the optimistic side as do some limited studies around the world, but ultimately we will only find out by trying. Perhaps you could start the discussion by elaborating on your comments to date.

John Griffin

What inference is to be drawn from a lower labor force participation rate than in the past? There are many possible reasons that might not require intervention. Two examples: some two-earner families may revert back to one-earner families in order to give more attention to their children; or more potential workers may be enlisted in training programs. With some thought, other possibilities may come to mind. The point is that the statistic alone is not sufficient support to justify a UBI.

ReplyDeleteWhy could not your wage concern be addressed by raising the minimum wage or lowering welfare support, in order to discourage labor force dropout at the low end of the wage scale? If my suggestion about setting a wage multiple were adopted, not only would the low end wage be substantially increased, but the fairer distribution of wealth would increase the spending base and demand, thereby requiring an increase in supply and the number of employment opportunities. Over the short term, it would act as an economic stimulus.

Giving people something that they do not earn reduces performance motivation. One may claim optimism about the consequence of a UBI, but the experiment has been run many times over (USSR, Venezuela, etc and a host of psychology lab findings). Facts are a more reliable basis for prediction than desires or opinions.

PMI,

ReplyDeleteIt is a pleasure to discuss this subject with you. You make good points worthy of consideration.

It is difficult to imagine, however, that a two-earner family would revert to one income unless the remaining income had increased enough to make up for a good part of the loss of the second income. And we see study after study showing how inflation-adjusted wages have been essentially stagnant for decades. I believe that that stagnation is due to competition from automation. When machines can do more every year, business owners have no need to attract workers by increasing their wages. I also believe that efforts to retrain workers will only slow rather than stop this march toward worker obsolescence.

I wholeheartedly agree that we need to address the problem of income inequality. In doing that we would also increase demand for and, thereby, the production of goods. The result may also include a temporary increase in employment. I expect, however, that increasing wages (through raising the minimum wage or mandating a certain wage multiple) will only give business owners more incentive to automate and accelerate the march toward worker obsolescence.

I suspect that the difference in our approaches comes down to whether each of us believes that, in today's world, automation ultimately destroys more jobs than it creates. If we do believe that, then no amount of wage adjustment will solve the jobs problem, and the UBI will be our best hope.

I agree that the USSR and Venezuela are good examples of the failures of Socialism (government ownership of production and distribution, etc.), but I don't see that they can be used as examples of the failures of a UBI. To the best of my knowledge they never tried a UBI.

John Griffin

John: Although you have not convinced me that the UBI is a great idea, you do have Facebook's Mark Zuckerberg onboard according to http://www.cnbc.com/2017/05/25/mark-zuckerberg-calls-for-universal-basic-income-at-harvard-speech.html

ReplyDeleteJohn: Apparently your imagination needs a bit of massage. When a couple has children, they often revert to one income, especially those more interested in quality of life than in amassing stuff. Along this non-materialistic line, many people retire earlier than in former years, and our aged population is increasing. These are other considerations relevant to interpreting the labor force participation rate.

ReplyDeleteRegarding automation, this primarily applies to the manufacturing segment of our economy. However, globalization and cheaper labor outside the US play a significant role in the loss of these jobs, perhaps even a greater role than automation in the US. As a result, our labor force has been retraining to meet the skill needs of a service economy. So I remain unconvinced that automation has any greater impact than it had a couple of decades ago, much less requires a massively costly solution applicable to all sectors of our economy. In my view, it would demotivate the retraining that is essential to keeping our workforce competitive. Your argument might have more legs in a developing economy that relies more heavily on manufacturing and has not yet experienced many decades of automation.

PMI,

ReplyDeleteWhen you recommend that I get my imagination massaged, is that to increase it or decrease it? Many have said that I already have too much :-).

I applaud anyone who chooses to put family ahead of material accumulation. Unfortunately, the realities of today’s job market make it difficult for many to afford that option. Raising a family and saving for the extra education that children will need in today’s world is increasingly difficult. A UBI could help a lot in those cases.

I know many seniors who “retired” early, and, in many cases, it wasn’t by choice. They wanted to work longer to save more for retirement, but were caught up in the incessant downsizing that plagues our economy.

I disagree that automation applies mainly to the Manufacturing sector. As I pointed out in my post, the percentage of the US workforce employed in the Agricultural sector has decreased from nearly 70 percent in 1840 to under 2 percent today. This is clearly due to automation and the consolidation of small farms that automation encourages.

Employment in our Industrial sector peaked in 1979 – nearly forty years ago. Since that time, Industrial sector employment has decreased by over one third. Many believe that is because “we don’t make anything in the US anymore”. And yet our domestic industrial output (in inflation adjusted terms) has more than doubled since 1979, and stands today at record levels. That could not happen without significant automation. I direct your attention to the appendix of my post that contains the text of an article titled “Why robots, not trade, are behind so many factory job losses”. Many other articles and studies agree that automation is a greater factor than foreign trade in our job losses.

The Services sector of the economy is certainly not immune to the effects of automation. Computers have eliminated or reduced employment in countless clerical jobs. Every week we read how another major retail chain is closing stores and shifting to an online sales model. Such a model requires far fewer employees and lowers costs significantly. They are forced to make this shift to compete with the Amazons of the world.

Please clarify. We are back to an unemployment rate of 4.4%, which is close to the low since 1950 and is below the rate in the vast majority of years since. Fluctuations in this rate appear unrelated to automation, which presumably has steadily increased in the past 65 years. See https://tradingeconomics.com/united-states/unemployment-rate. How does this confirm the crux of your argument?

ReplyDeleteWhile there was a steady rise in two-earner households from 1950 to the mid 80's, there has been a flattening of the % of two-earner families with children under 18 in the past two decades. See http://www.mybudget360.com/two-income-trap-working-couples-married-couples-working-percent-income-to-keep-up/. Let's say that more children are unable to find work, withdraw from the workforce, and return to live with their parents. With the extra burden on family finances, why is the continuing rise in automation not increasing the % of two-earner families?

If children move in with their parents and people are taking earlier retirement, why do they need a UBI, which would certainly not encourage them to find employment? Which percent of the population do you believe needs the UBI because they are unemployed due to automation, and where will the money come from? My own view is that funds would be better spent on training the unemployed for currently available careers and providing child care for those wishing to return to the labor force but constrained by child supervision obligations.

Imagination is a wonderful thing. :-)

PMI,

ReplyDeleteThe web page you cited states that the 4.4% unemployment rate "was the lowest jobless rate since May 2001, as the number of unemployed persons was little changed at 6.9 million and the labor force participation rate fell to 62.7 percent".

That web page essentially supports my argument. As I stated in my post, the unemployment rate is low because of unprecedented stimulus (from over eight years of near-zero interest rates) and because it ignores the decline in the labor force participation rate, and it ignores the number of employed people who are working part time when they would prefer full time, and it ignores the number of people who are working full time, but for less pay than they used to earn in better jobs.

The web page you cite in your second paragraph (mybudget360.com) also appears to support my argument when it says: "America has become a nation where households depend on multiple streams of income just to get by". and: "America is a nation of dual-income households because people are too broke to get by on one income. The current state of the economy hasn’t helped much in supporting economic growth for working families."

I believe we are well past the point where the average worker is capable of absorbing the level of education that is required for many of today's high skill jobs, and we may well be past the point where there are enough such jobs even if the training could be absorbed.

I also believe that when a UBI is offered it should be for 100% of the population over 18 years of age.

Ira,

ReplyDeleteOn May 18 you said:

"Thinking about your claim that we each deserve a "dividend, inheritance or license fee" based on the contributions of our ancestors, I wonder if a FAIR distribution of all we owe to those who have come before us would include actually tracing the sources to the recipients, when possible?"

And you added:

"Thus, people of Greek heritage living in the US would be ENTITLED to a larger share of the "dividend" due to the undoubtedly great contributions of Hellenistic philosophy and rationality to Western Civilization. Ditto for Italians due to the debt we owe to Roman Civilization."

I believe that the practical difficulty of tracing every thread of inheritance would produce enough errors to raise endless claims of unfairness. A single such example might be those who are of Roman descent but, more recently, are descended from criminals in the Italian Mafia. Such examples could be endless. We can also say that no person alive today had any control over the lineage to which they were born. It is, therefore, simpler to declare that everyone has an equal claim to our economic heritage.

A theory needs to make accurate predictions. If automation is continuing to create unemployment, then the jobless rate should b going up. It is not. There are too few trained workers for currently available jobs. Automation had its major impact years ago. Focus now should be on retraining the unemployed who wish to work. You predicate a need on an unproven assumption - that reduction in the labor force participation rate means people who have withdrawn from the labor force need a UBI to survive. Where's the proof. I retired early and have no plan to work again unless given an offer I can't refuse. No horsehead in my bed yet. While anecdotal evidence is insufficient proof of anything, I doubt my case is unique.

ReplyDeleteA greater national concern is our nation's ballooning debt. I am not in favor of bequeathing greater societal obligations to my grandchildren unless these are already established or critical to survival. I remain unconvinced that the UBI falls into the latter category.

PMI,

ReplyDeleteWe have had a good exchange of facts, ideas and opinions. I believe we have, however, reached the point where we are not going to change each others outlook on the main issue of unemployment and its causes. I believe that automation and technology is now destroying more jobs than it is creating and that process will accelerate. You disagree. I also believe that within ten to fifteen years the destruction of jobs by automation will have become painfully obvious, and the discussion of a Universal Basic Income will be common at all levels of government. I guess we will just have to wait and see.

I have become aware of a number of videos on the subject of robots, automation and the future of employment. If you are interested, you can find some at the following web page address: https://www.youtube.com/results?search_query=marshall+brain+on+robotics+and+employment

Apparently you believe that the discussion should be over because this is an undecidable difference of opinion. I do not think that is the case. Existing data on the US Labor Force Participation Rate do not support your contention. The automation scare which began in the 19th century was revived in the 1960's. Rather than reducing labor force participation as direly predicted then, the rate increased between 1965 and 2000, as the data that you provided show. While the rate has decreased in the past 16 years, it remains well above the participation rate in the 1960's. I believe we are going through a transition period in US employment largely driven by globalization and the 2008 financial crisis. As China and India have been able to offer cheaper labor costs in manufacturing and some service areas, there has been pressure on the US labor force to change its skill set. The drop in labor force participation over the past decade and a half reflects that, as well as immigration of less skilled workers willing to do menial jobs for lesser pay and early retirement of the increasing percentage of those over 60. We are only talking about a 4% overall drop, so the significance of the role of automation is unclear. An increasingly egalitarian role of women in our workforce can account for the rising percent of jobs held by women over the past half century.

ReplyDeleteIn any case, while the recent rate of job loss may continue to increase in future, it may also decrease or flatten. Absent certainty of the prediction upon which you predicate a need for a UBI, there is insufficient evidence that we should establish a UBI at this time. If the data do support your prediction in future, then we can reconsider a UBI along with alternative options (e.g., increasing the earned income credit), taking account of their costs and other societal ramifications. You have not made a persuasive case for immediate adoption of a UBI, but it remains an option worth continued scrutiny.

A more erudite perspective on this topic is provided by MIT Economics Professor David Autor: https://economics.mit.edu/files/11563